Afghanistan and China Welcome Chabahar Port

9 Feb 2017

Iran’s Chabahar Port Deal with India and Afghanistan. What the Agreement Means for China and Pakistan

Recently, Afghanistan and India planned to start air freight services over Pakistan. Afghanistan exports, such as Afghan dry fruits and carpets exports to India and Indian medicines imports to Afghanistan will be key benefits of the latest trade developments between the two neighbours. To consolidate India-Afghanistan trade via air freight forwarding, a memorandum of understanding is being signed.

This air freight cargo follows Afghanistan, India and Iran, signing the Chabahar Port deal in Tehran, covering various aspects of transportation and logistics. Chabahar port has been feted as a key rival to the China-Pakistan Economic Corridor (CPEC), centred on Gwadar port in Pakistan. Certainly, for Kabul officials, the Chabahar port agreement is seen as important for growing the Afghanistan economy via overseas exports.

Afghanistan’s ambassador to India, Shaida Mohammad Abdali, said the deal was “heralding a new era in regional integration.” The tripartite deal means that this land-locked country is no longer dependent on Pakistan for transportation and trade between India and Afghanistan, or the rest of the world.

The Chabahar Vs. Gwadar Dilemma?

Geo-politics of “Pashtunistanism” and the Durand border conflicts between Afghanistan and Pakistan saw a similar proposal by Afghanistan decades ago in the 1950s. Afghan trade through Pakistan ground to a halt. Readers may be surprised to learn that at this time, Kabul asked Washington for help in creating a new transit route through Iran to Chabahar Port with the aim of by-passing Pakistan.

Back then Iran and the U.S. rejected Afghanistan’s proposal , viewing Chabahar Port as “impractical” financially. This makes the development all the more intriguing.

Now Pakistan regards the trilateral trade agreement suspiciously, either in terms of the relative benefits of Chabahar vs. Gwadar, or in terms of Pakistan’s security. Munir Akram, a former Pakistani ambassador to UN, refers to a “new Great Game” played out between China, Russia and the U.S. in the region’s geopolitics.

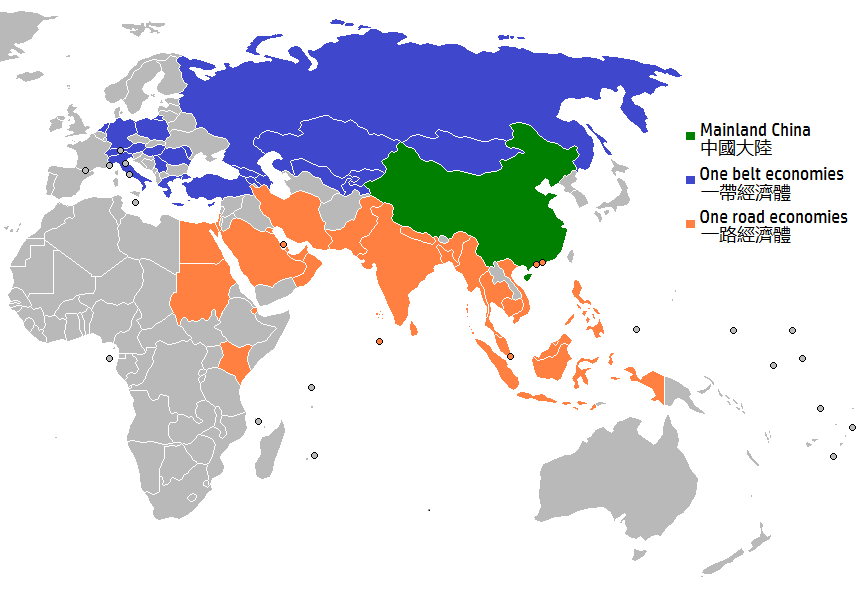

China’s One Belt, One Road (OBOR) and China-Pakistan Economic Corridor (CPEC) plays their part in the overland transportation mix here. Indian supported projects, including Chabahar and American transportation infrastructure projects in Afghanistan are considered as rivals to China’s grand strategies.

Meantime Pakistan fears about strategic “encirclement” by India, and being “bypassed” in regional trade routes are obliging leaders to continue to smooth regional diplomatic relations when meeting.

Shifting Focus and Power Fulcrums

Whether or not India’s Prime Minister Narendra Modi’s really seeks to “isolate” Pakistan at the regional level and how much Pakistan’s rebels and hawks are doing that for themselves is open to debate. Certainly the Chabahar Port Agreement could be seen as an Indian reply to CPEC, as the Indian media has suggested. Whatever the power shake-ups, the shifting of power has always been a constant the world over as far back as we care to remember. Perhaps the important thing to focus on is what this all means for ordinary people, regardless of the apparent machinations of any particular country’s leaders.

Pakistan’s fears about losing freight business customers in Central Asia and Afghanistan might be simply that: fears. Certainly, there is scope for a sharing of profits of overseas shipping if Gwadar’s offer is attractive enough to regional exporters and importers.

Some Pakistanis are certainly supportive, whatever the reports elsewhere. For instance, the Pakistan Muslim League (Nawaz) of PML(N) government’s top officials have expressed their support for Chabahar and called Chabahar Port and Gwadar Port as “sister ports.” Indeed, Sartaj Aziz, who advises Pakistan’s Prime Minister, Nawaz Sharif, on foreign affairs, along with Tareq Fatemi, his special assistant on foreign affairs, have both referred to the option of linking Gwadar with Chabahar and building a road freight motorway between Peshawar and Chabahar.

The Chinese position on Chabahar it seems is fairly positive. Dawn.com has cited Chinese Prime Minister Li Keqiang as saying that Chabahar and CPEC, which includes Gwadar, are complementary. Of course, Chabahar Port will not only improve cargo transportation in Iran and Afghanistan, it potentially indirectly boosts Chinese projects.

At the Chinese Embassy in Kabul, reporter and strategic analyst, Ahmad Bilal Khalil asked a Chinese diplomat about Beijing’s stance on the Chabahar agreement, they said: “China welcomes interconnectivity in the region and hence it welcomes Chabahar port.” In regard to OBOR he stated that this is “inclusive”.

Chabahar Port and Gwadar Port: Exponential Regional Exports?

Both Chabahar and Gwadar are deep sea ports offering scope to increase options for international shippers in the region. The differences rest perhaps with China’s export strategy. CPEC aims to develop China’s western provinces via the Pakistan transit route. Western Chinese regions need energy imports and to export that region’s products to the Middle East and overseas via Gwadar and Karachi, cutting transportation and logistics time and costs. Chinese objectives are focussed largely on economics, geopolitics and energy security.

CPEC is a part of the larger OBOR initiative. China expects these projects to increase their trade to $2.5 trillion within a decade. OBOR takes in Central Asia, the Middle East, and the European Union, with whom Beijing has strong trade links. Ma Yuan’s book, ‘New Silk Road: A Journey Restarts’ quotes the EU as China’s largest trade partner since 2004 and offers the following insights into potential trading partner priorities.

- Trade with the EU is estimated at around $559.1 billion in 2013.

- With countries in Central Asia, Chinese trade is valued around $50.2 billion, an amazing jump from $460 million in 1992. Perhaps the driver here has been Central Asian republics declaring independence from the former Soviet Union.

- In 2012, bilateral trade with Gulf Cooperation Council states was $155 billion (i.e. Saudi Arabia, United Arab Emirates, Qatar, Bahrain, and Oman - Watch that space for further trade agreements.)

- China is dependent on the Middle East, Central Asia, and Russia for its energy resources. OBOR enhances energy and trade exchange with these regions.

Chabahar does not impact on China’s ability to achieve their trade goals, thus having no incentive to undermine CPEC. Chabahar port is purely about boosting global freight transportation options with Central Asian republics and Afghanistan. Pakistan and Iran both have reason to celebrate investment from foreign trade partners.

Afghanistan for their part welcome Chinese projects. They signed an MoU with Beijing to become a part of OBOR in 2016. In relation to CPEC, Afghan officials have also been positive. The former Afghan ambassador to Pakistan and the new Afghan ambassador to China, Janan Mosazai, have said that Kabul “…supports[ the] China-Pakistan Economic Corridor. We would like to link up with it.” Mosazai also said that Kabul will “… facilitate the linking of Central Asian countries with the corridor.”

Iran will also get more involved in OBOR given Tehran’s increasing openness to world trade. Iran sees the benefit of connecting CPEC and Chabahar, including Gwadar. As Afghanistan and Iran take part in OBOR, Chabahar is not likely to directly compete with the Chinese project.

The Chabahar vs. Gwadar perspective revolve around two main concerns. Firstly, a Chinese and Indian naval military presence around these ports potentially increases Sino-Indian rivalry in the Indian Ocean; to assume this is likely to create instability, however, is a stretch of the imagination. Second, Chabahar port could diminish the importance of Gwadar hub and route for Central Asian republics and Afghanistan. Given the potential scope for trade in the region, this however, is pure discomfort over competition concerns, when the reality of increasing regional growth looks likely to be a boon to both ports.

Military use of either port by foreign partners remains to be seen. Iran’s participation in any Sino-Indian strategic rivalry seems unlikely when Sino-Iranian economic, political, and strategic relations may outweigh Indo-Iranian relations. Here’s how the figures look at this time:

- Currently India Iran trade is around $14 billion,

- China and Iran trade has been valued at $51.8 billion

- A year ago, China and Iran agreed to increase bilateral trade to $600 billion in the next 10 years.

China and Russia vetoed United Nations Security Council resolutions against Bashar al-Assad’s regime in Syria, a strategic ally of Tehran.

United States and India have strong ties. This may be significant to Iranian strategists. India using Iran’s ports for militarily purposes against China when Tehran considers the Indo-U.S. alliance in the Indian Ocean as against its own interests makes any Pakistan fears over militarisation of Chabahar seem just that: fear. Indeed, the Iranian envoy to Pakistan has invited both Pakistan and China to be partners in the Chabahar Agreement.

The Chinese envoy to Iran has said that Chinese firms are prepared to invest in Chabahar evidenced by Chinese technocrats visiting Chabahar Port in 2016, with a possible view to also furthering of Iranian energy deals. An joint MoU on the creation of an industrial town in Chabahar was signed in 2015.

Afghanistan-Pakistan transit problems existed prior to the Chabahar deal being signed which have led to Afghan traders have diverted their attentions to Bandar-e-Abbas in Iran. According to Afghanistan’s deputy minister of commerce and industries, Muzamil Shinwari, “…in 2008-2009 nearly 60 percent of Afghan imports were transited from Pakistan, but now, in 2016, it is not even 30 percent.” Similarly, he pointed out: “…nearly 15-20 percent Afghan imports were transited from Iran in 2008-2009 but it is now 37-40 percent.” (Emphasis added).

This shift of Afghanistan imports and exports towards Iran and away from Pakistan is less about Chabahar port and more about the risks associated with freight cargo in Pakistan and the fact that Pakistan does not want to facilitate Afghan exports to India. Islamabad has informed Pakistani media that they intend entering into a quadrilateral agreement with Central Asian republics and China to further their transportation and logistics options. Pakistan will thereby bypass Afghanistan to reach Central Asian trade partners via China and CPEC.

Afghanistan Needs Chabahar

Chabahar addresses Afghanistan’s international freight forwarding issues vis a vis Pakistan. However, more than overcoming their land-locked status, Afghanistan’s trading partners operating via the Afghanistan-Pakistan Transit Trade Agreement (APTTA) need to have continued transit of goods. Afghanistan requires access to its trade partners: China, the United States, Malaysia, Indonesia, India, UAE, Kenya, Vietnam, Hong Kong, and South Korea.

Chinese imports to Afghanistan, in particular, through APTTA has consistently exceeded 30 percent of Afghanistan imports in recent years. According to commentators, the absence of a direct trading route with China through Wakhan pass and technical problems associated with rail freight links between Afghanistan and China, Pakistan and CPEC are still important to Kabul.

So, despite Chabahar also being looked to by Afghan exporters, in the short term, this route has still got untapped capacity. Longer term, a combination of factors seem set to bring into question Afghan trade preference in the long term. The persistent transportation logistics and trade problems for Afghans transiting Pakistan are an increasing driver of switching to Chabahar.

Islamabad’s reluctance to make India a part of an Afghan-Pakistan transit trade agreement, plus alternate routes opening for Afghan imports from China via Pakistan (the five-nations railway line linking China, Kyrgyzstan, Tajikistan, Afghanistan, and Iran, along with a smoothly-functioning China-Afghanistan rail link) mean Pakistani transit route questions remain.

Afghanistan’s and India’s troubles with transport routes via Pakistan certainly seem set to continue, however, Pakistan may yet agree to make India a part of APTTA. We watch and wait with an eye always to the future opportunities. Meantime, Afghan businesses continue to turn their eyes to Chabahar Port as a safe alternative…

(Image source: Wikipedia: OBOR)

our contact form.

The White Rose Group looks forward to hearing from you.